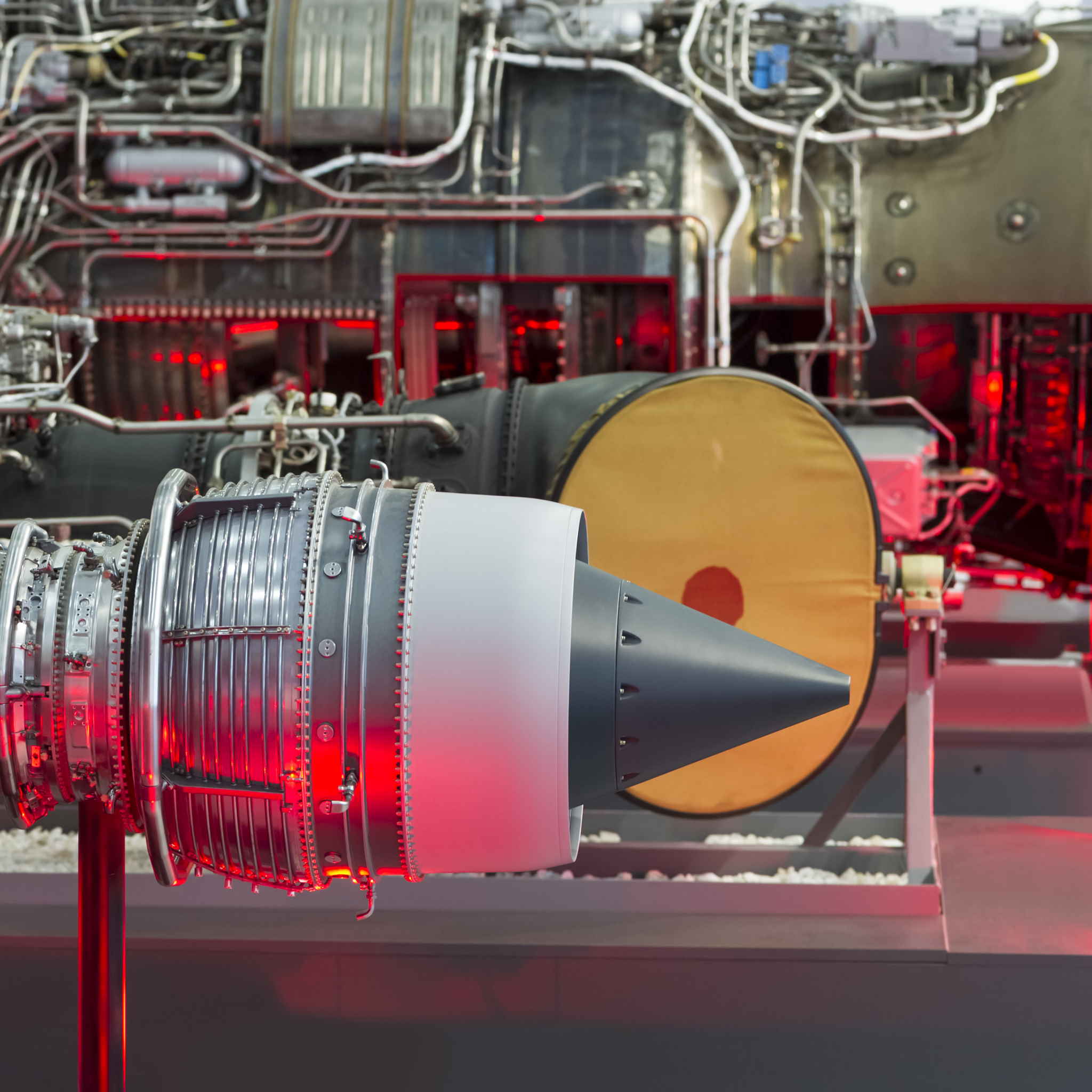

Aerospace

The global aerospace parts manufacturing market was estimated at $887 billion in 2018. The market is expected to expand at a CAGR of 3.9% from 2018 and 2025. The rise in fleet replacement to retire aging aircrafts with new-generation, lightweight, and fuel-efficient aircrafts is anticipated to be the main driver for growth within this market.

The global aerospace parts manufacturing market was estimated at $887 billion in 2018. The market is expected to expand at a CAGR of 3.9% from 2018 and 2025. The rise in fleet replacement to retire aging aircrafts with new-generation, lightweight, and fuel-efficient aircrafts is anticipated to be the main driver for growth within this market. Energy cost continues to be the most significant expense in aircraft operations, thus impelling the replacement of in-service aircrafts with superior fuel-efficient alternatives. The necessity to reduce fuel consumption creates a tremendous opportunity for market participants. Additionally, market leaders look to increase service life of standard components through the adoption of new surface technology increasing longevity. The market’s move towards the incorporation of lightweight materials enables quick adoption of new technologies.

Aerospace

The global aerospace parts manufacturing market was estimated at $887 billion in 2018. The market is expected to expand at a CAGR of 3.9% from 2018 and 2025. The rise in fleet replacement to retire aging aircrafts with new-generation, lightweight, and fuel-efficient aircrafts is anticipated to be the main driver for growth within this market. Energy cost continues to be the most significant expense in aircraft operations, thus impelling the replacement of in-service aircrafts with superior fuel-efficient alternatives. The necessity to reduce fuel consumption creates a tremendous opportunity for market participants. Additionally, market leaders look to increase service life of standard components through the adoption of new surface technology increasing longevity. The market’s move towards the incorporation of lightweight materials enables quick adoption of new technologies.

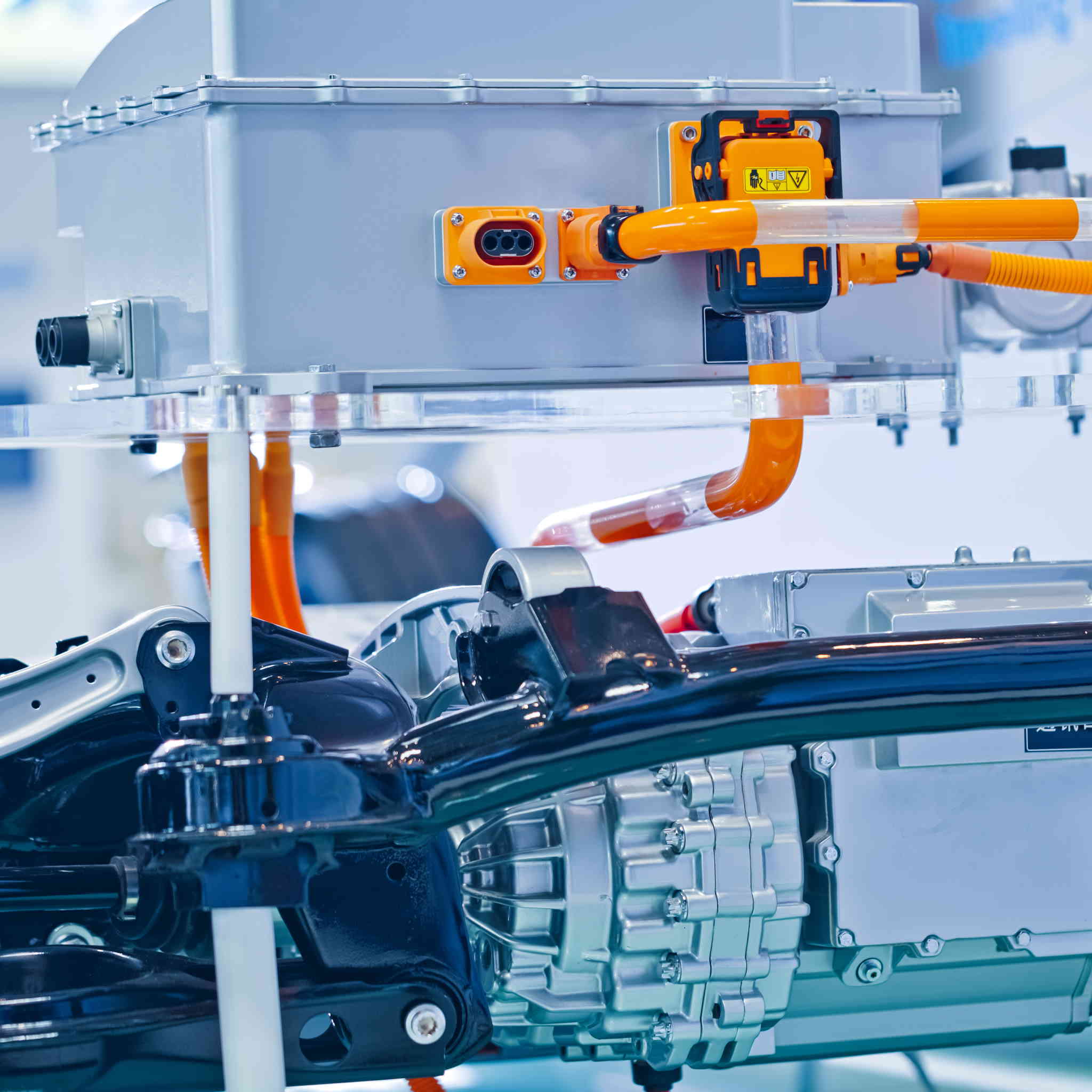

Automotive

The United States has one of the largest automotive markets in the world. In 2018, U.S. light vehicle sales reached 17.2 million units, the fourth straight year in which sales reached or surpassed 17 million units. Overall, the United States is the world’s second-largest market for vehicle sales and production. The automotive industry is also at the forefront of innovation. New R&D initiatives are transforming the industry to better respond to the opportunities of the 21st century.

Automotive

The United States has one of the largest automotive markets in the world. In 2018, U.S. light vehicle sales reached 17.2 million units, the fourth straight year in which sales reached or surpassed 17 million units. Overall, the United States is the world’s second-largest market for vehicle sales and production. The automotive industry is also at the forefront of innovation. New R&D initiatives are transforming the industry to better respond to the opportunities of the 21st century. According to Auto Alliance, of the $105 billion spent in R&D this year, almost a fifth ($18 billion) is spent in the United States. In 2018, the United States exported 1.8 million new light vehicles and 131,200 medium and heavy trucks (valued at over $60 billion) to more than 200 markets around the world, with additional exports of automotive parts valued at $88.5 billion. With an open investment policy, a large consumer market, a highly skilled workforce, available infrastructure, and local and state government incentives, the United States is the premier market for the 21st-century automotive industry.

Defense

The combined weapon sales from American companies for the 2018 fiscal year were up 13 percent over 2017 fiscal year figures, netting American firms $192.3 billion in additional gross receipts. At 2018 fiscal year end, American industry had completed $55.66 billion in foreign military sales, an uptick of 33 percent over 2017 fiscal year end’s $41.93 billion in gross sales.

Defense

The combined weapon sales from American companies for the 2018 fiscal year were up 13 percent over 2017 fiscal year figures, netting American firms $192.3 billion in additional gross receipts. At 2018 fiscal year end, American industry had completed $55.66 billion in foreign military sales, an uptick of 33 percent over 2017 fiscal year end’s $41.93 billion in gross sales. The substantial increase in Foreign Military Sales process is a direct resultant of the U.S. government successfully acting as a go-between for foreign partners and American industry. In addition to the go-between support from the US government, new legislation regulating potential defense sales has started to create a surge in international weaponry sales. The increase in gross revenue from the preceding two years has spurred an influx of new capital geared adoption of new, efficient, technology creating an immense opportunity for American industry.

Energy

For the first time ever, in April 2019, renewable energy outpaced coal by providing 23 percent of US power generation, compared to coal’s 20 percent share.1In the first half of 2019, wind and solar together accounted for approximately 50 percent of total US renewable electricity generation, displacing hydroelectric power’s dominance. Declining costs and rising capacity factors of renewable energy sources, along with increased competitiveness of battery storage, drove growth in 2019.

Energy

For the first time ever, in April 2019, renewable energy outpaced coal by providing 23 percent of US power generation, compared to coal’s 20 percent share.1 In the first half of 2019, wind and solar together accounted for approximately 50 percent of total US renewable electricity generation, displacing hydroelectric power’s dominance. Declining costs and rising capacity factors of renewable energy sources, along with increased competitiveness of battery storage, drove growth in 2019. In the first half of the year, levelized cost of onshore wind and utility-scale solar declined by 10 percent and 18 percent, respectively, while offshore wind took a 24 percent dip.2 The greatest decline was in lithium-ion battery storage, which fell 35 percent during the same period.3 This steady decline of prices for battery storage has begun to add value to renewables, making intermittent wind and solar increasingly competitive with traditional, “dispatchable” energy sources. New technology in increase cell storage capacity is responsible for a massive investment in onshore technology firms accelerating development lead times and driving production adaption.